Warning: count(): Parameter must be an array or an object that implements Countable in /hermes/walnacweb03/walnacweb03ag/b859/moo.bestmastersineducati/bestfinanceschools/wp-content/plugins/really-simple-facebook-twitter-share-buttons/really-simple-facebook-twitter-share-buttons.php on line 538

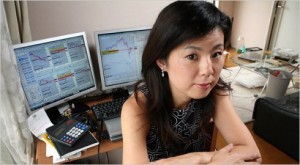

In the financial world, there are few jobs more chaotic, frenzied, and potentially lucrative as that of the typical day trader. The actual “day trader” title originates from the types of investment trades being done by these professionals: Rather than buying investment mechanisms and holding onto them for at least one day, or even several days, day traders buy and sell rapidly in an effort to close out all trades at the end of the business day. This requires an astute awareness of how the stock market works, how certain types of news will affect certain stocks, and how speculating on certain companies or trading styles can lead to big profits if handled the proper way. It’s not an easy job, and it requires extensive training for those who wish to make a living doing it.

In the financial world, there are few jobs more chaotic, frenzied, and potentially lucrative as that of the typical day trader. The actual “day trader” title originates from the types of investment trades being done by these professionals: Rather than buying investment mechanisms and holding onto them for at least one day, or even several days, day traders buy and sell rapidly in an effort to close out all trades at the end of the business day. This requires an astute awareness of how the stock market works, how certain types of news will affect certain stocks, and how speculating on certain companies or trading styles can lead to big profits if handled the proper way. It’s not an easy job, and it requires extensive training for those who wish to make a living doing it.

How to Become a Day Trader: Get a Good Education Beforehand

The work of day trading is quick and intense, and it requires an education that will allow financial professionals to make instant judgment calls, educated bets, and quick moves between stocks, mutual funds, and other tools. This requires at least a bachelor’s degree in finance. The courses contained in a finance degree program teach students about broader economic theories as well as the minute details of investing in various mechanisms, making trades, and maximizing the value of a given portfolio within any wind of time.

Though it’s a good start, however, a bachelor’s degree in this field is often not enough. The best day traders have invested significantly in their education, and have often received a Master of Science in Finance at a respected institution as well. This higher-level degree gives professionals the more in-depth understanding of the markets that they need to make a series of more successful trades throughout the day.

Risk and Reward: Most Day Traders Lose Money for the First Several Months

Though the quick trades and day-ending closeouts of day trading can make for a lucrative position in the long run, it’s important to understand that most day traders spend the first few months of their career losing money. That’s simply because adjusting to this type of fast-paced trading takes a bit of adjustment at first. It’s also because most traders have to acquire instant news feeds and subscribe to financial wire services in order to make their trades, and these subscriptions are some of the most expensive in any industry.

The up-front costs, combined with the learning curve, mean that most day traders spend an average of 3 months losing more money than they earn from the profession. After that, however, their income level can rise dramatically depending on how good they are at these sophisticated and quick types of trades.

Related Resource: Loan Officer

Good for Researchers, Risk-Takers, and Quick Stock Traders

The name of the game in day trading is to be informed, quick, and willing to take a significant financial risk if it means maximizing an investment portfolio within the traditional business day. Trading stocks only within a single business day does present quite a few challenges, especially for investors who previously worked in more traditional stock management or financial advising firms. According to The Washington Post, after a period of adjustment, however, most day traders understand how to leverage their portfolio, take advantage of corporate developments as they unfold, and make fast trades that produce an appropriately fast financial gain.

Follow

Follow